Home Loan Calculator

Loan Calculation Result

Monthly Payment: 0.00

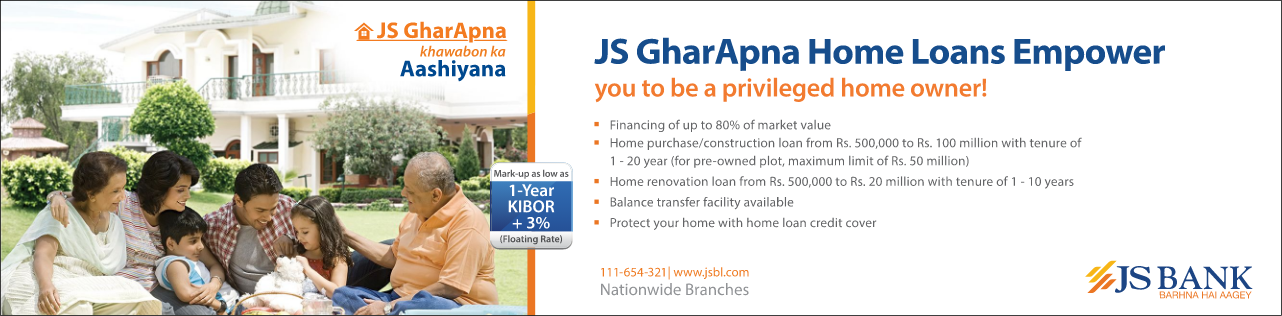

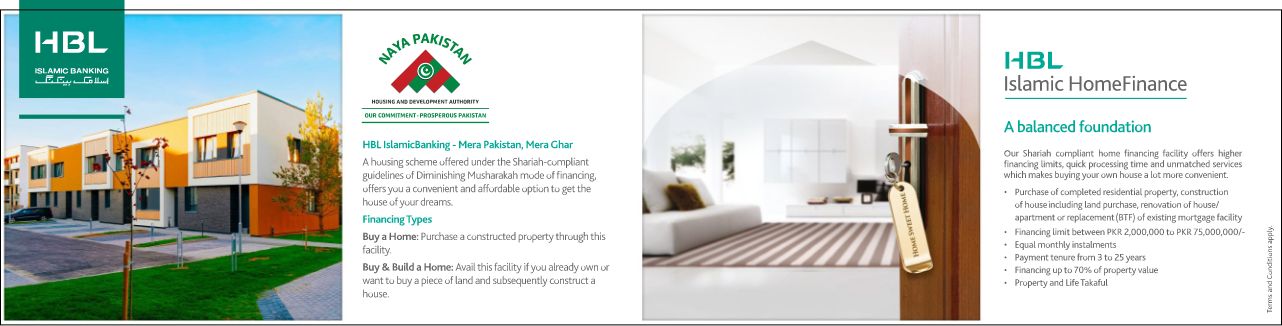

Banking Partner

Everyone dreams of owning their own house at some point in their life. However, this is not easily achievable given the fact that the process requires a lot of dedication, consideration, and of course, money. Having said that, this does not mean that you should become disheartened with the entire venture, and not give it a shot. The process of buying a house or property, in general, can seem particularly threatening for first-timers. No matter where in the world you are, there are some legal aspects attached to buying a piece of real estate that you need to look out for. To make the whole endeavor easier for buyers, Jaidadtrade introduces Home Loan Calculator. Additionally, there are numerous home/house financing options available in the market with almost every major bank trying to provide the best means to address this pressing issue. Use this tool to evaluate the best house financing option there is. Now if you are worried about how you can score a decent home loan in Pakistan, there’s no need to fret! You can easily find a bank plan that suits your financing/payment needs. However, it is pertinent to mention here that your eligibility for these various house financing options depends on several factors – ranging from your salary to your nationality. Also, different banks have different eligibility standards when approving home loan applications. Therefore, to figure out the best bank in Pakistan for the purpose, weigh your options carefully with Jaidadtrade’s Home Loan Calculator. In addition, the sanctioned loan amount, as well as the duration you have to repay it over, may vary from bank to bank. Your debt-to-equity ratio is also an important factor, so make sure that you have a strong case to present when submitting your house loan application.